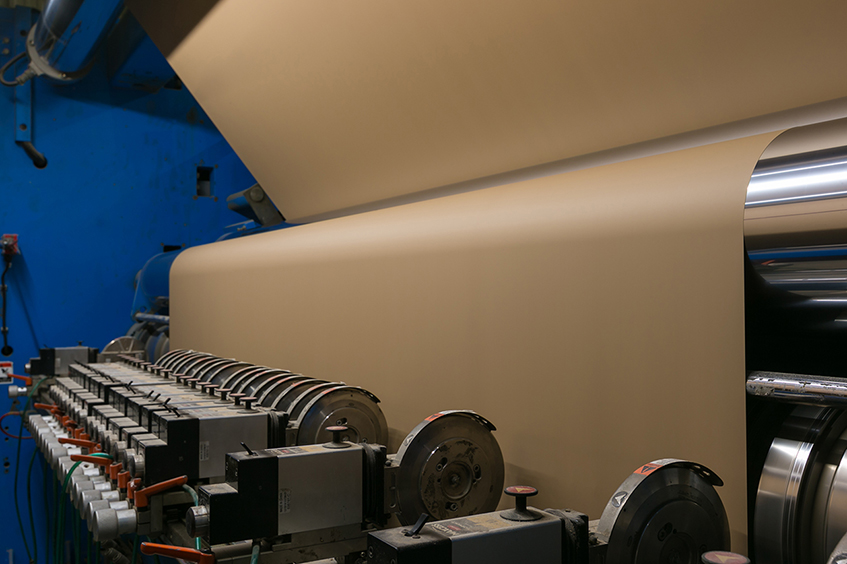

Fastmarkets RISI Viewpoint: A brief look at the GCC antidumping duties on

containerboard

BRUSSELS, April 11, 2019 (Viewpoint) – By Gleb Sinavskis, Economist, European

Paper Packaging, Fastmarkets RISI

On March 31, the Gulf Cooperation Council’s (GCC) Bureau of Technical Secretariat

of Anti-Injurious Practices in International Trade (GCC-TSAIP) imposed antidumping

duties on fluting and uncoated testliner exports from Spain and Poland, starting

May 1, 2019, for a period of five years. There are six trade codes mentioned, with

recycled liner and recycled fluting below 105 g/m2 exempted. The final dumping

margin as a percentage of the CIF value has been determined to be 24.6% for

imports from Spain by SAICA and 31% for other Spanish companies and 34% for

Polish exporters.

Which companies will potentially be affected? First, of course, is SAICA, which was

specifically mentioned in the official letter from GCC. Other companies with

significant fluting and recycled liner capacity in Spain and Poland include Mondi,

Smurfit Kappa Group, DS Smith and Stora Enso.

The GCC consists of Saudi Arabia, Kuwait, United Arab Emirates, Oman, Bahrain

and Qatar. Looking at the overall GCC uncoated containerboard trade balance with

Europe, including Russia and Turkey, there was about a 200,000 tonne import

deficit for 2018, with very little volume coming from GCC to Europe. The majority of

exports from Europe in 2018 were recycled containerboard, with only about 50,000

tonnes of virgin containerboard. In the largest export category, recycled linerboard,

out of 135,000 tonnes of overall imports, Spain accounted for 50,000 tonnes.

However, the above information is just a snapshot of the yearly figures. More

important are the dynamics we have seen through the years. Exports from Europe

to GCC were about 440,000 tonnes in 2016. They declined to 330,000 tonnes in

2017 and 220,000 tonnes in 2018 due to tighter markets in Europe. Most of the

volume reduction was done by the top exporting countries, with the top spot on the

exporter list remaining unchanged (Spain, Germany, Sweden and Finland for each

grade). For example, Spanish recycled liner exports decreased from 106,000

tonnes in 2016 to 77,000 tonnes in 2017 and 50,000 tonnes in 2018.

What did this mean for market prices in GCC? With less available import supply,

containerboard prices in GCC region soared. But following the weaker global and

European demand, the situation has started to change in the second half of 2018.

European producers, after seeing higher inventories and weaker demand in their

domestic market, started shipping at monthly levels not seen since 2016. In 2016,

containerboard exports to GCC were about 30,000-40,000 tonnes per month, but

had reduced to 10,000-15,000 tonnes by the second quarter of 2018. However,

shipments in November 2018 were 23,000 tonnes and reached almost 30,000

tonnes in December. With the increasing volumes, recycled containerboard prices

in the GCC plummeted, with some reports indicating export prices of less than

€300/tonne, which is close to cash cost for many European mills.

The duties involve only specific codes, namely fluting and recycled liner grades.

However, these codes cover almost 100% of shipments in fluting and uncoated

recycled linerboard from Spain and Poland. The total export volume under these

codes from Spain and Poland was 60,000 tonnes in 2018, down from 159,000

tonnes in 2016 and 93,000 tonnes in 2017. However, the monthly shipments

indicate that volumes doubled in late 2018 compared to the summer months,

repeating the overall export story. The vast majority of the volume in this trade

code set was uncoated testliner below 150 g/m2 coming from Spain.

What does this mean for European exports to the GCC countries? The producers in

the GCC have sent a clear signal that they will not welcome the return of the high

import volumes seen before the top of the business cycle in Europe. However, will

putting duties on Spain and Poland be enough to limit import growth in the GCC

region? I don’t believe so. The oversupply that currently exists in Europe will

undoubtfully result in more containerboard exports to the MENA region, including

the GCC countries, in one way or another.

This is a prime example of how dangerous it is to rely on export trade these days,

in times of global trade wars and de-globalization rhetoric. The containerboard

market saw direct effects of this last year, following the import tariffs on US

kraftliner in China and Turkey and the decline of European exports in general that

led to a slowdown in containerboard demand at home. This GCC ruling is just

another step in this direction, and I suspect we could see more cases like this going

forward.

Gleb Sinavskis, Economist, European Paper Packaging, author of the Paper

Packaging Monitor Europe, the European Paper Packaging 5-Year Forecast and the

European Paper Packaging 15-Year Forecast, works out of Fastmarkets RISI’s

Brussels office and can be reached at +32 (0)2 536 07 41 or

[email protected].